The pattern in Example 2 & 3 above works with different interest rates. Try the free Mathway calculator andproblem solver below to practice various math topics. Try the given examples, or type in your ownproblem and check your answer with the step-by-step explanations. You can also use several free compound interest calculators online.

How do you calculate compound interest?

As you can see, over a long period of time, compounding makes a large difference in the account balance. You may recognize this as the difference between linear growth and exponential growth. The earlier you start saving money, the more money you earn in interest. If it is compound interest, your interest earns interest, meaning you’re earning more every time interest is paid.

How to calculate

Had the investment only paid simple interest (5% on the original investment only), annual interest would have only been $5,000 ($500 per year for 10 years). This formula assumes that no additional changes outside of interest are made to the original principal balance. Compounding typically refers to the increasing value of an asset due to the interest earned on both a principal and an accumulated interest. This phenomenon, which is a direct realization of the time value of money (TMV) concept, is also known as compound interest. Compounding, therefore, differs from linear growth, where only the principal earns interest each period. Compound interest is the phenomenon that allows seemingly small amounts of money to grow into large amounts over time.

Which Type of Average Is Best Suited to Compounding?

The total initial principal or amount of the loan is then subtracted from the resulting value. Interest is the amount of money you must pay to borrow money in addition to the loan’s principal. It’s also the amount you are paid over time when you deposit money in a savings account or certificate of deposit. You are essentially loaning money to the bank, and it is paying you interest.

When interest is compounded monthly, how many periods are there in:

This is different from simple interest in which a consistent amount of money, derived from a percentage of the principal, is paid to the holder of the loan periodically. I created the calculator below to show you the formula and resulting accrued investment/loan value (A) for the figures that you enter. Looking back at our example, with simple interest (no compounding), your investment balanceat the end of the term would be $13,000, with $3,000 interest. With regular interest compounding, however, you would stand to gain an additional $493.54 on top. If you’re using Excel, Google Sheets or Numbers, you can copy and paste the following into your spreadsheet and adjust your figures for the first fourrows as you see fit.

With compound interest, he earned an additional $66 in that time. With a higher balance, the compound growth would be even bigger – and would only grow larger over time. If an amount of $10,000 is deposited into a savings account at an annual interest rate of 3%, compounded monthly, the value of the investment after 10 years can be calculated as follows… There are different types of average (mean) calculations used in finance.

- When you put money into a savings account, the bank will use your money, for example by lending it to other people.

- When you borrow money, you will have to pay interest as well as paying back the original amount.

- Click here to read about Addition Financial’s partnership with CUNA Brokerage Services and book an appointment with one of their Financial Professionals.

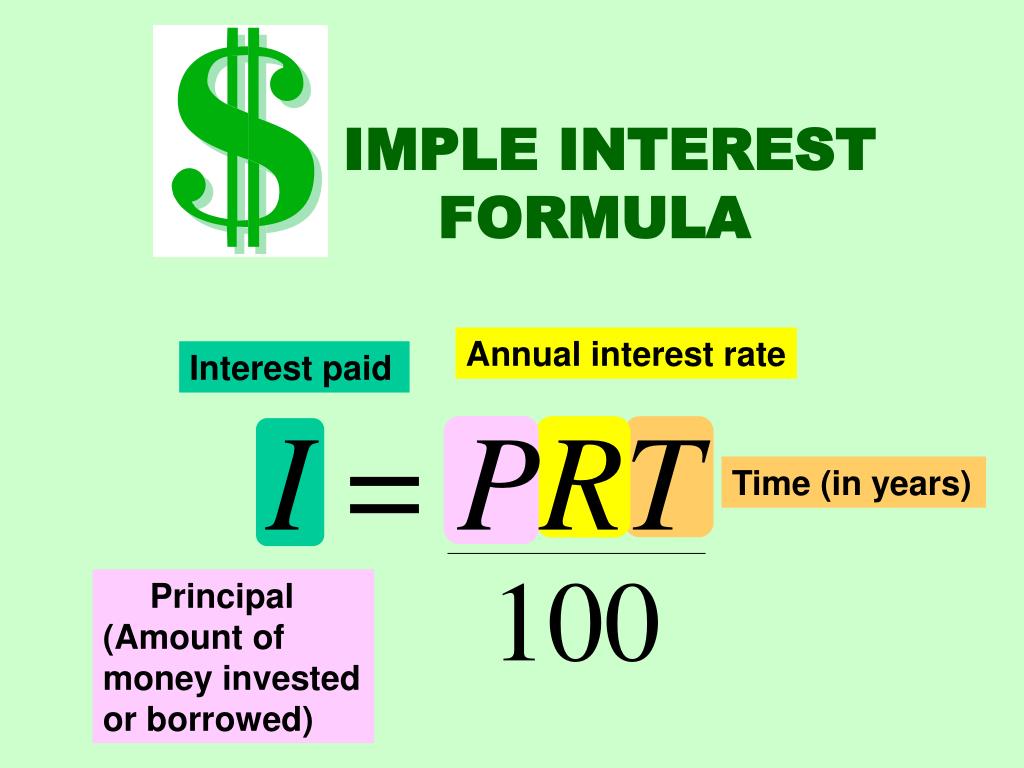

Simple interest is generally applied to short-term loans, usually one year or less, that are administered by financial companies. The same applies to money invested for a similarly short period of time. The simple interest rate is a ratio and is typically expressed as a percentage. Suppose we observe our bank statements, we generally notice that some interest is credited to our account every year. This interest varies with each year for the same principal amount.

Mortgages and car loans, for example, use simple interest, while savings accounts and certificates of deposits incorporate compound interest. In addition to compound interest, investors can receive compounding returns by reinvesting dividends. This means taking the cash received from dividend payments to purchase additional invoice template for sole traders shares in the company—which will, themselves, pay out dividends in the future. The effects of compounding strengthen as the frequency of compounding increases. For example, if a stock investment paid you a 4% dividend yield and the stock itself increased in value by 5%, you’d have total earnings of 9% for the year.

Click here to read about Addition Financial’s partnership with CUNA Brokerage Services and book an appointment with one of their Financial Professionals. Below table shows the process of calculating interest and total amount. The price of a radio is Rs. 1400 and it depreciates by 8% per month. Let us understand the process of calculating compound interest with the help of the below example. The above formulas help determine the interest and amount in case of compound interest quickly. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.