For example, if a company has total common equity of $1,000,000 and 1,000,000 shares outstanding, then its book value per share would be $1. Rather than buying more of its own stock, a company buy xero shoes at rei and get a $10 xeroshoes com gift certificate can use profits to accumulate additional assets or reduce its current liabilities. For example, a company can use profits to either purchase more company assets, pay off debts, or both.

How does BVPS differ from market value per share?

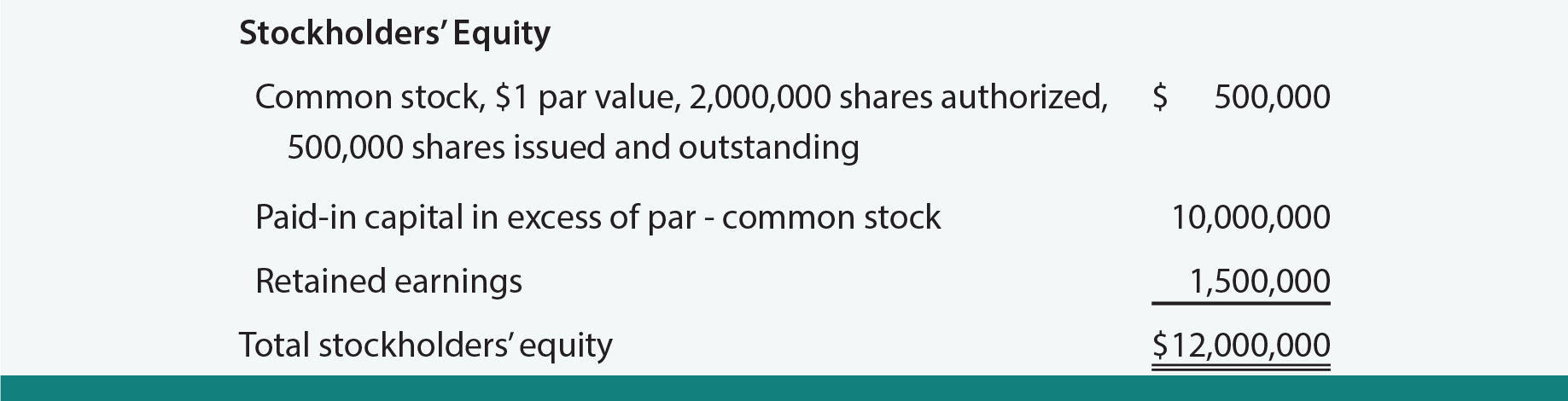

In return, the accumulation of earnings could be used to reduce liabilities, which leads to higher book value of equity (and BVPS). Nevertheless, most companies with expectations to grow and produce profits in the future will have a book value of equity per share lower than their current publicly traded market share price. If we assume the company has preferred equity of $3mm and a weighted average share count of 4mm, the BVPS is $3.00 (calculated as $15mm less $3mm, divided by 4mm shares). The Price-to-Book Ratio maintains the connection between the net value of a company’s assets as shown on the balance sheet and the entire value of its outstanding shares. Common stocks from its shareholders, the company can increase the book value per share from Rs. 8 to Rs. 10. What counts as a “good” price-to-book ratio will depend on the industry in question and the overall state of valuations in the market.

How Does BVPS Differ from Market Value Per Share?

Conceptually, book value per share is similar to net worth, meaning it is assets minus debt, and may be looked at as though what would occur if operations were to cease. One must consider that the balance sheet may not reflect with certain accuracy, what would actually occur if a company did sell all of their assets. A company’s stock is considered undervalued when BVPS is higher than a company’s market value or current stock price. If the BVPS increases, the stock is perceived as more valuable, and the price should increase.

Best Penny Stocks Under Rs. 10 – Based on Fundamental Factors

This may be a more useful valuation measure when valuing something like a patent in different ways or if it is difficult to put a value on such an intangible asset in the first place. Due to accounting procedures, the market value of equity is typically higher than a security’s book value, resulting in a P/B ratio above 1.0. During times of low earnings, a company’s P/B ratio can dive below a value of 1.0.

- For example, if a company has total common equity of $1,000,000 and 1,000,000 shares outstanding, then its book value per share would be $1.

- The book value per share is just one metric that you should look at when considering an investment.

- Now, let’s say that XYZ Company has total equity of $500,000 and 2,000,000 shares outstanding.

A business is usually seen as beneficial for investment if its P/B ratio is 1 or less. To understand what is PB ratio in share market deeply, keep reading this detailed guide ahead. As a result, investors must first determine the market capitalisation of a company by multiplying the current market price of its stocks by the total number of outstanding shares. Many investors use the price-to-book ratio (P/B ratio) to compare a firm’s market capitalization to its book value and locate undervalued companies. This ratio is calculated by dividing the company’s current stock price per share by its book value per share (BVPS).

How to Interpret BVPS?

If XYZ can generate higher profits and use those profits to buy assets or reduce liabilities, the firm’s common equity increases. Book Value Per Share or BVPS is used by investors to determine if a company’s stock price is undervalued compared to its market value per share. To calculate book value per share, simply divide a company’s total common equity by the number of shares outstanding.

Now, let’s say that XYZ Company has total equity of $500,000 and 2,000,000 shares outstanding. In this case, each share of stock would be worth $0.50 if the company got liquidated. Should the company dissolve, the book value per common share indicates the dollar value remaining for common shareholders after all assets are liquidated and all creditors are paid. Although infrequent, many value investors will see a book value of equity per share below the market share price as a “buy” signal.

It may be a value trap rather than a value opportunity as companies’ assets can be treated differently in different industries. For example, in most cases, companies must expense research and development costs, reducing book value because this includes the expenses on the balance sheet. However, these R&D outlays can create unique production processes for a company or result in new patents that can bring royalty revenues. It is difficult to pinpoint a specific numeric value of a “good” price-to-book (P/B) ratio when determining if a stock is undervalued and therefore, a good investment. A company should be compared with similarly structured companies in similar industries; otherwise, the comparison results could be misleading. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more.

The figure of 1.25 indicates that the market has priced shares at a premium to the book value of a share. There is also a book value used by accountants to value the assets owned by a company. This differs from the book value for investors because it is only used internally for managerial accounting purposes. By multiplying the diluted share count of 1.4bn by the corresponding share price for the year, we can calculate the market capitalization for each year.